First Steps

Most people will advise you to begin a business by planning financing or researching taxes. These are important but not the primary tasks to be done. Before you cope with these issues, you need to address the subsequent issues:

- Know your product or service. Ask yourself, “What business am I in?” the solution requires a degree of specificity. (In a large corporation, the board of directors should ask this question at every quarterly meeting.)

- Know your customers or clients. You cannot determine your needs for money, work space, or time to launch your business until you answer these questions accurately.

Clearly defining your business means asking more questions:

- What is the character of your business? Be specific.

- Who are your customers or clients?

- Where are your customers or clients?

- Why should they buy your product or service?

- Why should they pass away from you?

If you don’t have customers, you don’t have a business!

Unique Selling Proposition (USP)

A unique selling proposition distinguishes your business from businesses of competitors. Your USP is additionally your “area of distinctive competence.”

Put yourself within the position of your customer. Would you purchase from your company? Why or why not? to work out a way to set your business apart:

- Define your USP.

- List factors that make your business stand above the competition.

- List advantages your business can provide (and your competitors can’t).

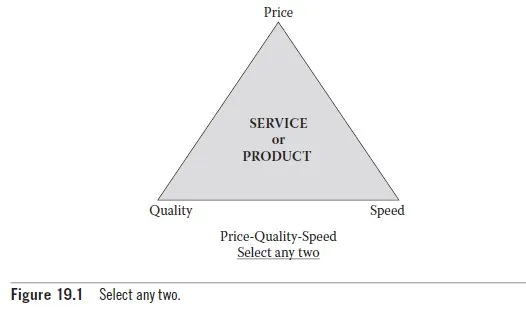

Customers take a look at three factors once they choose a product of service: price, quality, and speed (see Figure 19.1).

You will move out of business if you try and achieve being the most effective in all three.

Construct a Strategic conceive to include what you would like to try and do with your business…whether you propose to make it, or build it and sell it.

If you’re a personal starting your own business your plan need only be a pair of pages. It’s possible to urge so engrossed in the planning that you just don’t get to the particular starting of the business.

There’s a time for planning and a time for action.

Know that only about 50% of what people tell you is true. The untrue part consists of both deliberate lies and, more often, people telling you what they think is true. Verify information. Know which are the accurate sources and which are not…that’s people, websites, news media, relatives, friends, associates, etc. (this was addressed, Current Concepts, Trends and Tools).

Partners: Pros and Cons

Have you considered starting a business with one or more partners?

Do you need them? If they need some talent needed for your business (and you don’t have it), give some thought to a partnership. However, every participant during a team or partnership must “bring something to the table” like expertise or financing. Without participation, you don’t need a partner.

If you opt to pursue a partnership, determine the degree of partnership participation with relation to financing, deciding, and effort; then engage an attorney to arrange a partnership agreement covering these points and the other legal issues. Partnerships fail when partners can’t agree on purchases, services or products, customers, and other issues, or when one partner doesn’t carry his share of the responsibilities.

Beware of anyone who wants you to place up the money and he will put in “sweat equity” and “knowledge.” you’re taking all the risks and they are taking none.

Beware of involving relatives within the business. Having similar DNA only goes to date. It doesn’t mean you and a blood relation have the same personalities, work ethic, risk taking characteristics, energy, and so on.

Beware of anyone who, in your opinion, isn’t carrying his/her share of the work, finance, and responsibility. they’re simply taking from you and giving nothing reciprocally.

Know how to acknowledge when people lack integrity and don’t deal with them. Learn the first indications of people’s lack of integrity.

Let’s take a look at the case where some other person is starting a business and wants you to be a partner. watch out for anyone who wants you to try and do the work and rather than paying you money wants to relinquish you “stock options”. they need you to figure for them for nothing. they require your knowledge, expertise, and contacts. (Yes indeed – contacts – they require you to introduce them to your friends, who after they need been fleeced by this “partner” will not be your friends.) If their company fails you have options on nothing and that they have all of your contacts.

People with whom you are doing business should have the subsequent characteristics:

- Look you within the eye and recognise with you.

- Pay promptly.

- mustn’t start conversations by saying that “…things are tough and also the budget is tight…” with their department or company. (They’re visiting attempt to get a reduction for no real reason aside from they’re cheap. If you provides it to them they won’t pay on time anyway.)

- mustn’t start conversations by saying that the nation’s economy is slow. (They’re visiting try and get a reduction for no real reason apart from they’re cheap. If you provides it to them they won’t pay on time anyway.) That’s the identical parenthetical comment as in Number 3 above.

Customer Issues

Your customers should also follow certain ethical practices. A customer should look you within the eye, shake your hand, not complain about tough economies and tight budgets and, most significantly, pay promptly. For more information about working with customers.

Your customers will expect certain behavior from you. Don’t “nickel and dime” your customers. What would you think that if a restaurant charged you for sugar, mustard, or water? Such practices drive customers to competitors. you must allow yourself a good margin on your product or service and thus not must implement small charges that annoy customers. A business can fail by charging all-time low prices to undercut competition. An inadequate margin implies that a slight adversity sort of a late payment can start a business on the road to financial problems.

View your business from your customer’s view. Call your business to assess the treatment your customers receive. If you’ve got an internet site and “contact us” link, try it. Measure the time required to induce a response and check other parameters of the location. Ask an admirer to go to your business as a customer and make a buying deal to judge customer treatment. Contact the customer service department. Experiencing customer treatment is that the best thanks to check performance—better than accounting evaluations, marketing surveys, and blaming the economy. Viewing your business as your customer sees it allows you to diagnose problems effectively and solve them quickly.

Financing and Credit

Don’t borrow money to begin a business unless you have got no choice.

Never use credit cards to finance a business! they’ll legally charge up to 30% interest.* Trying to repay large mastercard debts can require energy you ought to devote to putting together your business and customer base.

You may occasionally need credit within the start-up of your business.

Establish a relationship along with your bank and acquire to grasp the bank manager personally. an honest relationship together with your bank will benefit both of you.

Ask the bank to ascertain a line of credit to be used as required instead of seeking a loan. this may enable you to borrow smaller amounts and pay less interest than you’d on an outsized lump-sum loan. For example, a $100,000 line of credit means amount is obtainable to you. If you would like $25,000, you’ll withdraw that quantity and retain an available balance of $75,000; and you may pay interest only on the $25,000 used.

Don’t handle lenders who base decisions only on a credit report.

Credit reports will be erroneous because reporting companies acquire information from various sources and don’t verify its accuracy. Deal only with lenders who talk with you and fairly evaluate your ability to repay a debt. Consider the standard of the lender together with interest rate. Sometimes a lender whose rate could be a bit higher (a tenth of a point) could also be more understanding if you’ve got a brief problem and can assist you in figuring out a brand new schedule of payments. this is often a situation in which it’s beneficial to understand the director. Never make late payments or skip payments; communicate with the lender and work with him to resolve the matter.

Lenders can assist you by providing differing types of business financing like term loans and revolving lines of credit (discussed above). additionally to those traditional sorts of financing, you may want to analyze whether equity financing (or venture capital) could be a viable option for obtaining business capital. study various credit products and choose one that suits your needs.

5 Comments